Margin in accounting meaning

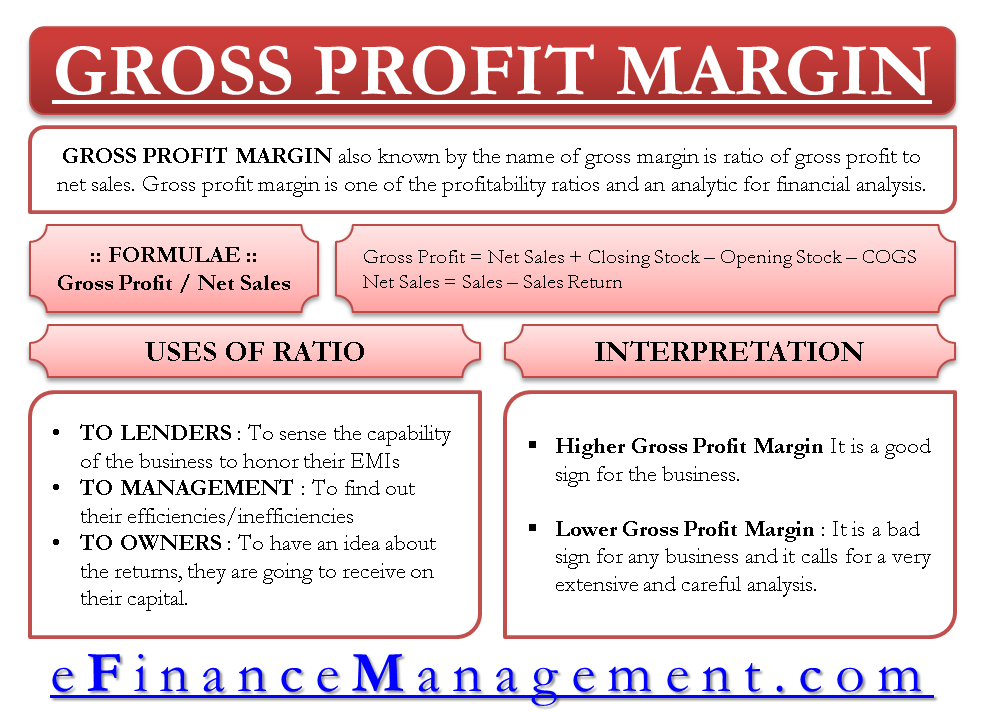

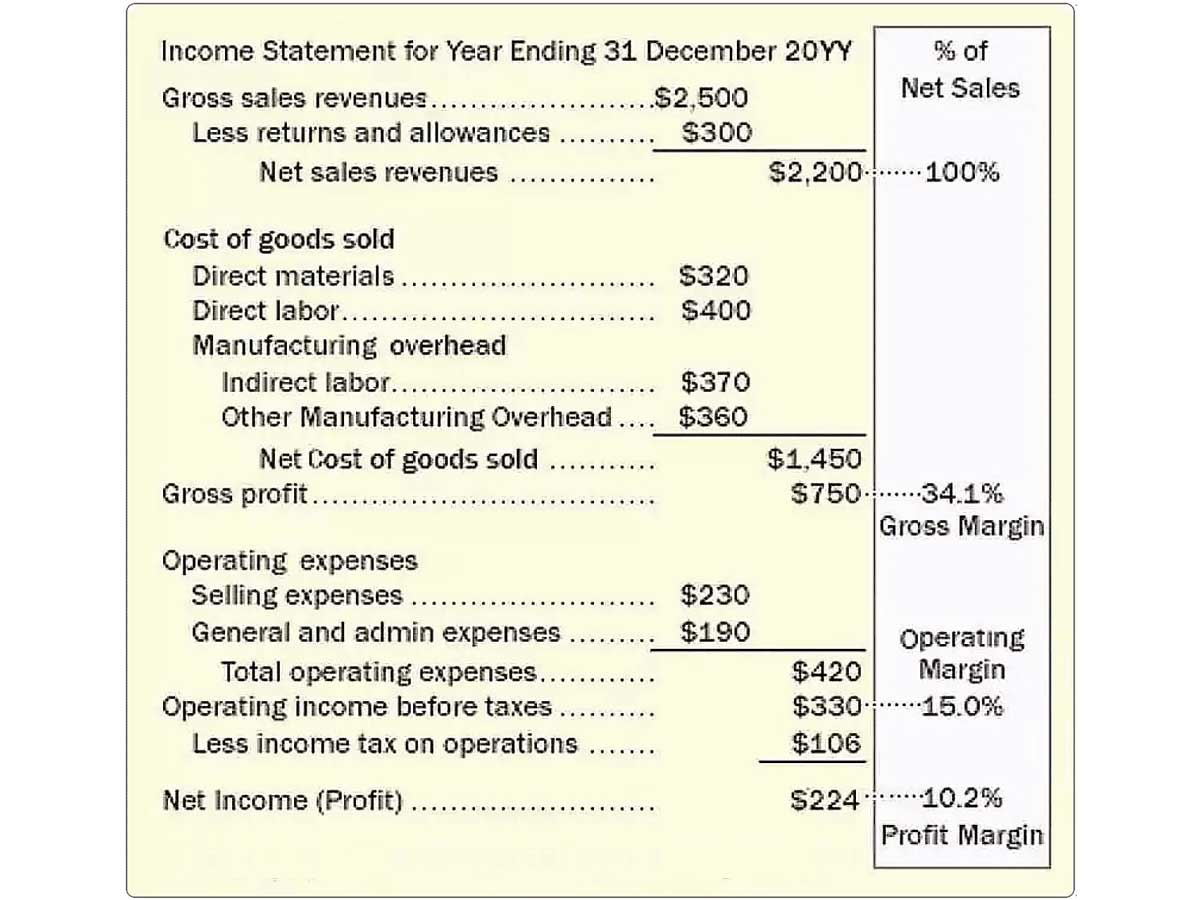

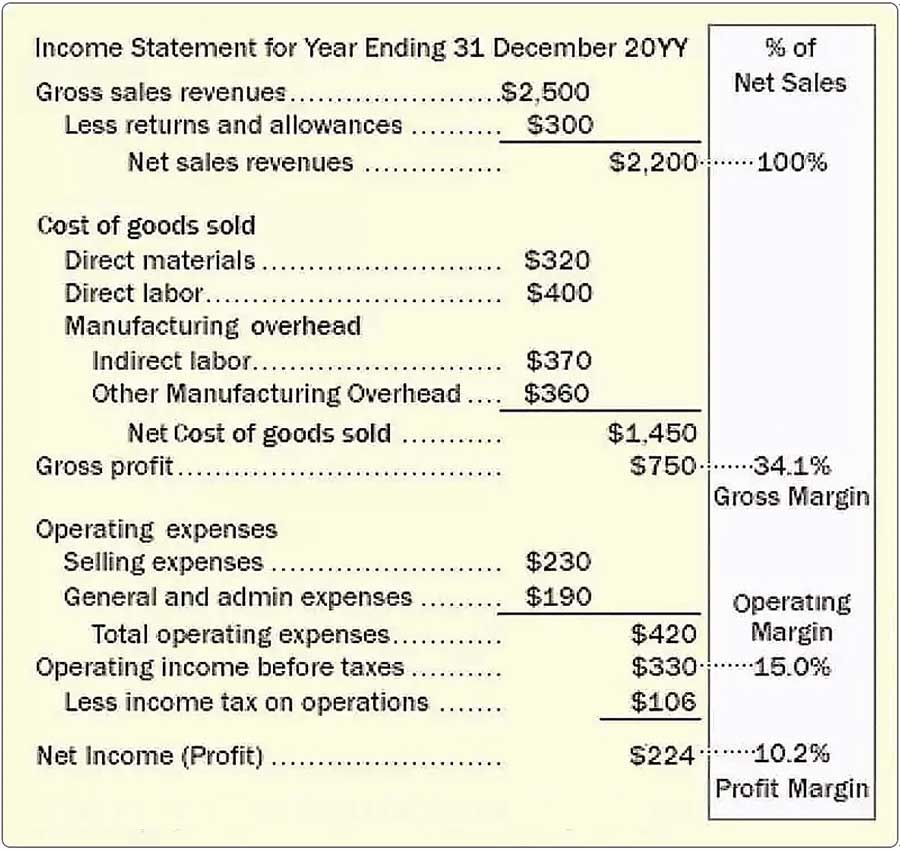

Profit margin is the percentage of sales that a business retains after all expenses have been deducted. The gross margin formula is calculated by subtracting cost of.

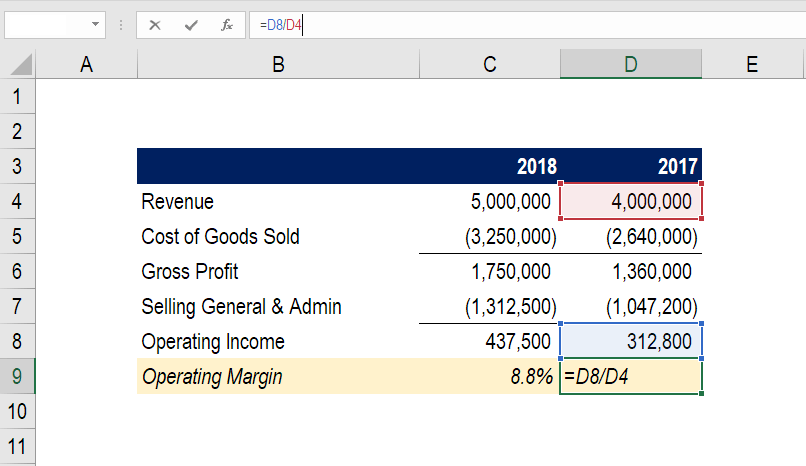

Operating Margin An Important Measure Of Profitability For A Business

A margin account is a brokerage account which allows you to borrow money against the investments in your account.

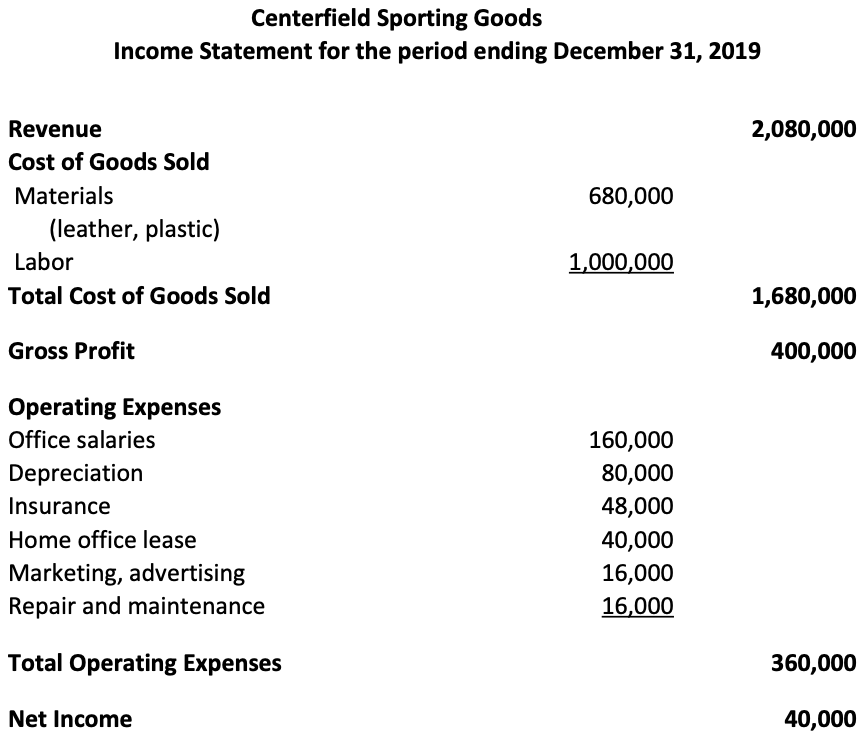

. NPM R COGS OE O I T R 1 0 0 or NPM Net income R 1 0 0 where. Money borrowed from a. Gross margin is the amount remaining after a retailer or manufacturer subtracts its cost of goods sold from its net sales.

The amount by which the. It is the ratio of net profits to revenues for a. A margin account is a type of brokerage account in which your broker-dealer lends you cash using the account as collateral to purchase securities known as margin.

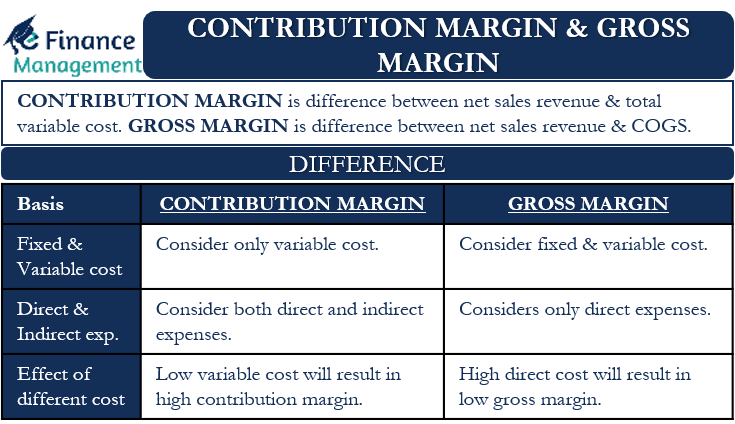

In investing margins refer to situations where an investor buys stocks. In accounting terms a standard margin is a measure of profitability for a business unaffected by one-time events the random and the unpredictable. The profit margin is a ratio of a companys profit sales minus all expenses divided by its revenue.

The net profit margin or simply net margin measures how much net income or profit is generated as a percentage of revenue. The profit margin ratio. Legal Definition of margin 1.

It is the ratio of profit divided by revenue. Margin also known as gross margin is sales minus the cost of goods sold. N P M net profit margin R revenue C O G S cost of goods sold O E operating.

In essence it shows the proportion of each dollar of sales that is retained. Lets say you purchase stock in a margin account. In other words gross margin is the retailers or manufacturers.

The difference between net sales and the cost of the merchandise sold from which expenses are usually met or profits derived 2. Gross margin often called gross profit is a financial ratio that measures how well a company can control its costs. Margin accounts charge an interest rate on the borrowed funds and demand a maintenance margin which is a fixed percentage of the total accounts equity.

Margin can be defined in two main ways. The 3 Types of Profit Margins and What They Tell You. This margin is the least.

For example if a product sells for 100 and costs 70 to manufacture its margin. This financial ratio is used to determine a companys profitability. In financial accounting margins refer to the same difference between revenue and cost in various stages.

What Is Gross Margin And How To Calculate It Article

What Is The Gross Profit Margin Bdc Ca

/dotdash_Final_How_Do_Gross_Profit_and_Gross_Margin_Differ_Sep_2020-01-441a7bebdebb492a8ac3a1e3ea890ab9.jpg)

How Do Gross Profit And Gross Margin Differ

Contribution Margin And Gross Margin Meaning Differences

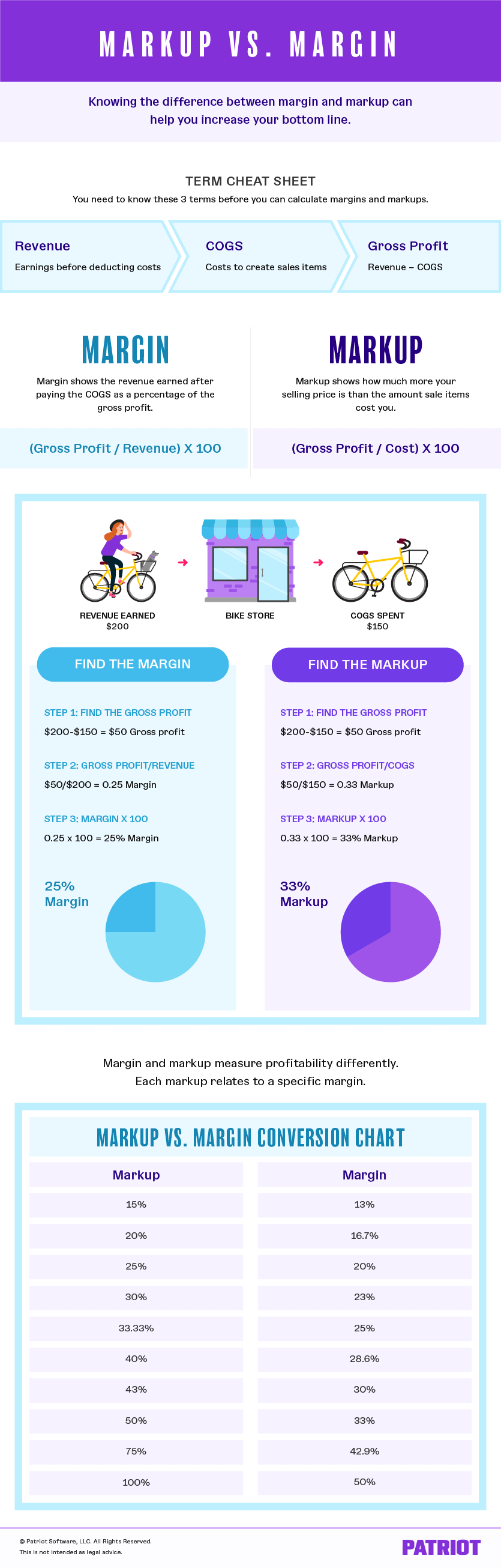

Margin Vs Markup Chart Infographic Calculations Beyond

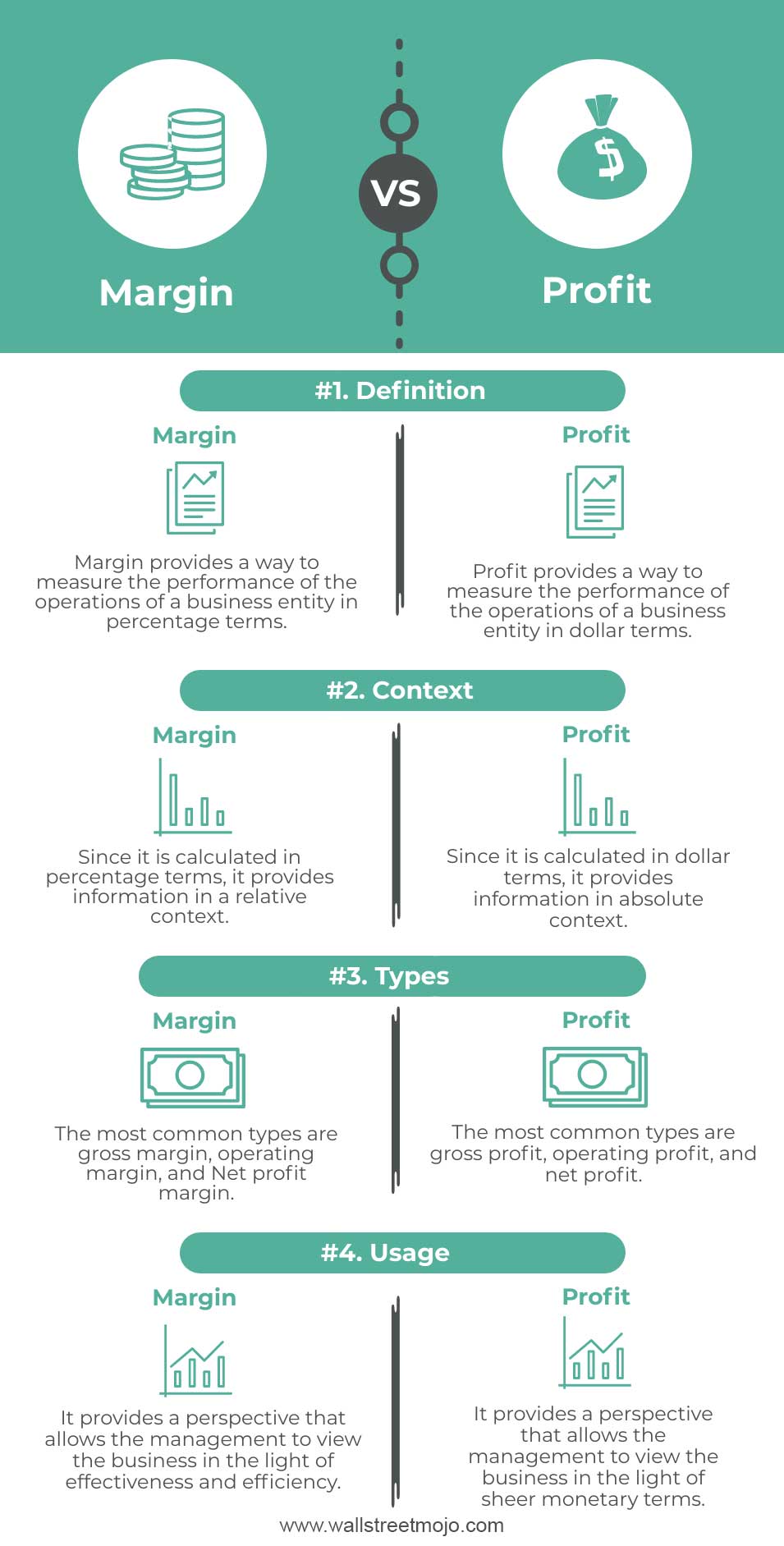

Margin Vs Profit Top 4 Difference With Infographics

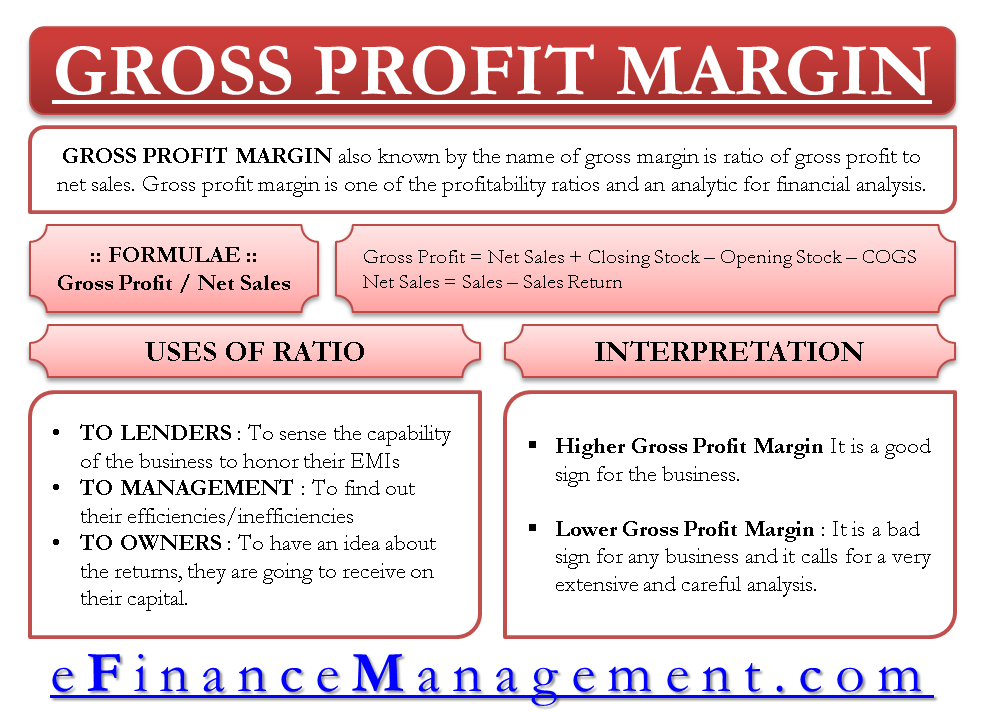

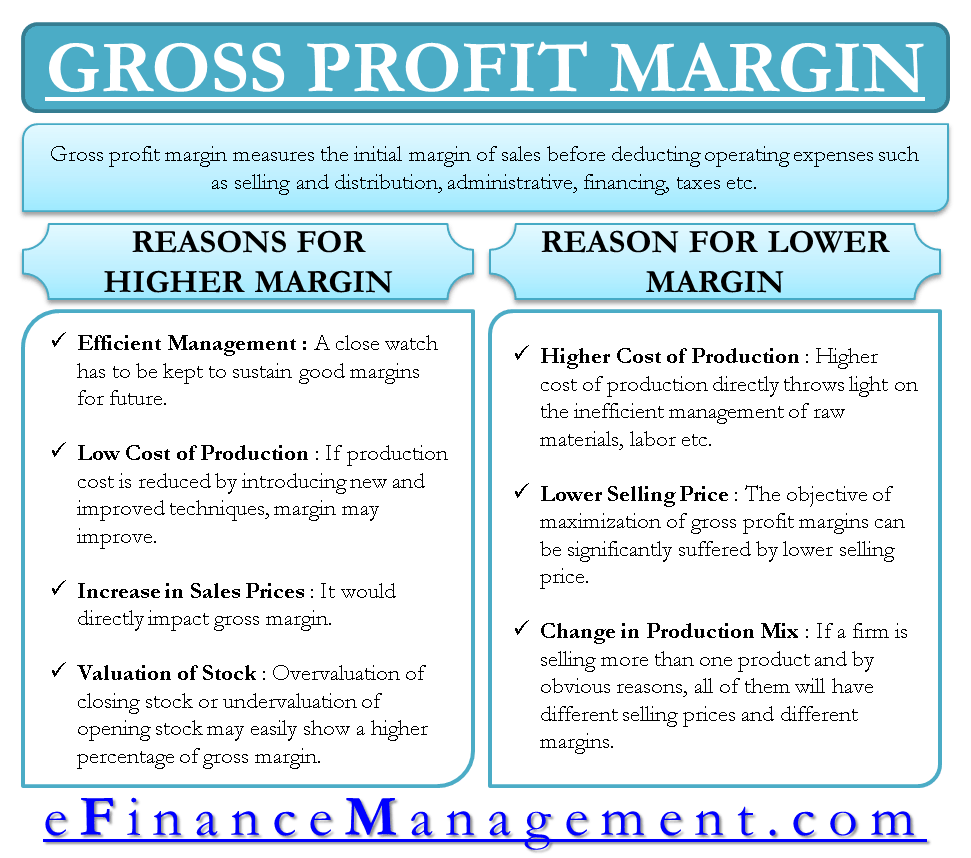

Gross Profit Margin Define Calculation Use And Interpretation Efm

/dotdash_Final_Gross_Margin_vs_Net_Margin_Whats_the_Difference_Nov_2020-01-de889f0261d2482780bda560dc14a6ce.jpg)

How Does Gross Margin And Net Margin Differ

Gross Margin Accounting Play Accounting Education Accounting And Finance Small Business Bookkeeping

:max_bytes(150000):strip_icc()/dotdash_Final_How_Do_Gross_Profit_and_Gross_Margin_Differ_Sep_2020-01-441a7bebdebb492a8ac3a1e3ea890ab9.jpg)

How Do Gross Profit And Gross Margin Differ

Margins Measure Business Profitability And Reveal Leverage

Gross Margin Ratio Formula Analysis Example

Gross Profit Margin Formula Meaning Example And Interpretation

Gross Margin Analysis Tips On How To Analyze Maximize Gp Margin

:max_bytes(150000):strip_icc()/dotdash_Final_Gross_Margin_vs_Net_Margin_Whats_the_Difference_Nov_2020-01-de889f0261d2482780bda560dc14a6ce.jpg)

How Does Gross Margin And Net Margin Differ

Margins Measure Business Profitability And Reveal Leverage

Markup Vs Margin Explained For Beginners Difference Between Margin And Markup Youtube