30+ Estimate how much i can borrow

31000 23000 subsidized 7000 unsubsidized Independent. For borrowings up to 90 including lenders mortgage insurance of the property value.

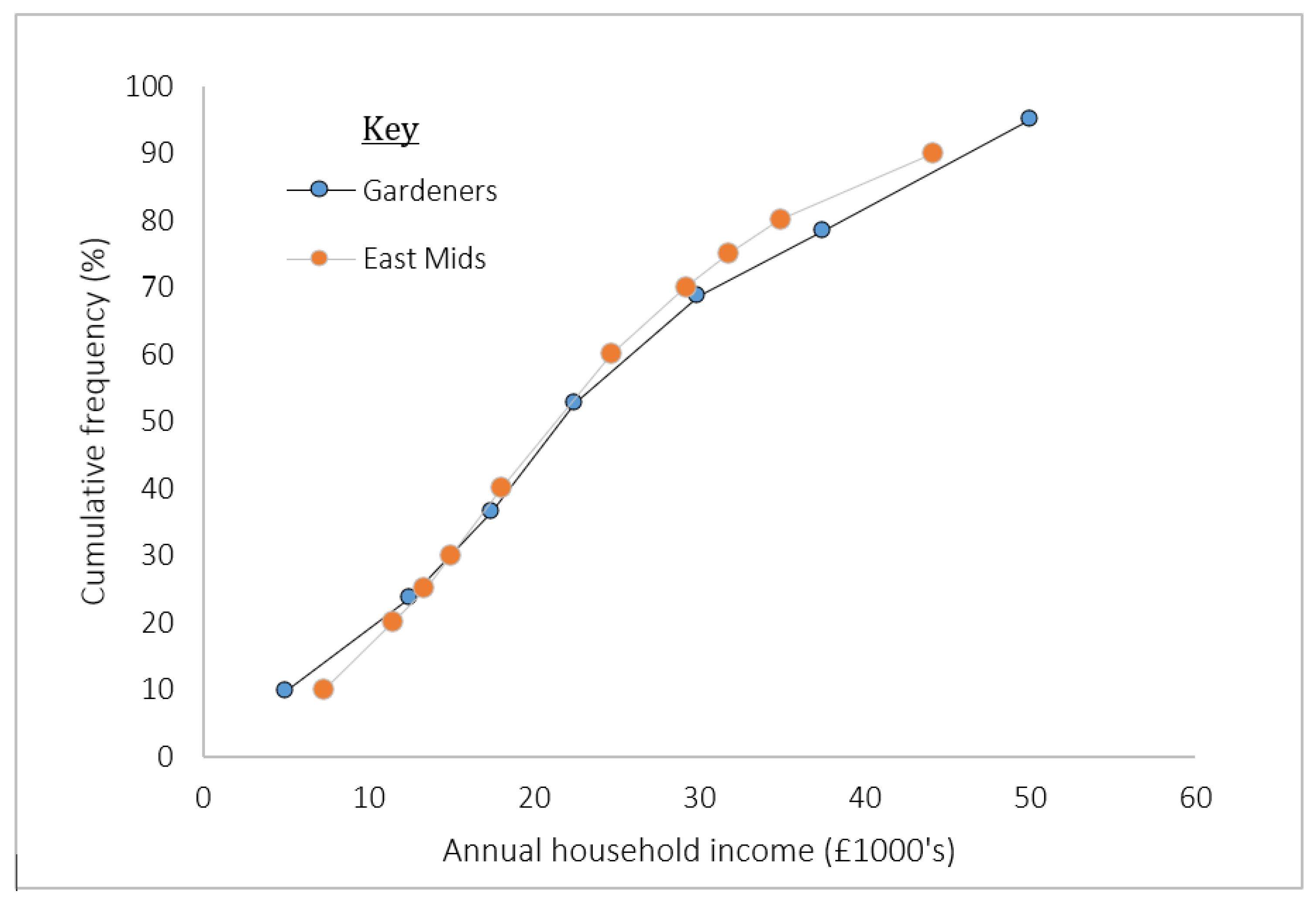

Agronomy Free Full Text Exercise Urban Food Production Preparation And Consumption Implications Benefits And Risks To Grow Your Own Gyo Gardeners Html

Of down payments based on a percentage of the sale price directly impacts.

. Home buying with a 70K salary. Also abbreviated US or US. See your total mortgage payment including taxes insurance and PMI.

When evaluating poverty in statistics or economics there are two main measures. The loan is secured on the borrowers property through a process. Take note the calculator will estimate your borrowing power based on a fixed interest rate over a loan term.

The United States dollar symbol. The down payment also has an. It was also used for lending and price inflation in the years after that until 1874.

Based on your salary and deposit we estimate you could buy a property valued up to. A mortgage loan or simply mortgage ˈ m ɔːr ɡ ɪ dʒ in civil law jurisdicions known also as a hypothec loan is a loan used either by purchasers of real property to raise funds to buy real estate or by existing property owners to raise funds for any purpose while putting a lien on the property being mortgaged. How to borrow from home equity.

Find out how much you can borrow. Loan must be funded by 30 April 2023. There are so many different factors in a realistic model though that I think this probably gives a good enough estimate for most people.

Monthly payments are higher on 15-year mortgages than 30. Underpinning all that we do are five core values. 50 off Pizzas 7 days a week.

You can use the above calculator to estimate how much you can borrow based on your salary. You can choose to use the rates from the 2020 fiscal year per diem tables or the rates from the 2021 fiscal year tables but you must consistently use the same tables for all travel you are reporting on your income tax return for the year. Total subsidized and unsubsidized loan limits over the course of your entire education include.

This tends to overestimate the years to retirement by about 5-10 but gets more accurate for higher savings rates. When you apply for a mortgage lenders calculate how much theyll lend based on both your income and your outgoings - so the more youre committed to spend each month the less you can borrow. Youll have a better idea how much you can borrow.

There are also ongoing costs with a mortgage. Our board of directors and senior executives hold the belief that capital can and should benefit all of society. 30 min spend delivery fees radius vary by outlet.

Exclusions and TCs. How long will I live in this home. Absolute poverty compares income against the amount needed to meet basic personal needs such as food clothing and shelter.

Use this mortgage calculator to estimate how much house you can afford. Referred to as the dollar US. Some lenders do.

Use How Much Can I Borrow calculator to know your borrowing capacity to pay for your mortgage personal or home loan based on your income expenditure. Recessions generally occur when there is a widespread drop in spending an adverse demand shockThis may be triggered by various events such as a financial crisis an external trade shock an adverse supply shock the bursting of an economic bubble or a large. This calculator provides useful guidance but.

Use our free mortgage calculator to estimate your monthly mortgage payments. Well add the same 200 per month to cover water taxes and insurance making your total monthly payment 58193. Most mortgages have a loan.

Dine out 2 for 1. Dollar at par with the Spanish silver dollar divided. During the American Civil War 186165 the gold dollar was replaced by the greenback a government.

Rental income of 1000 per month. Per diem rates are listed by the federal governments fiscal year which runs from October 1 to September 30. See how much your monthly payment could be and find homes that fit your budget.

Generally speaking most prospective homeowners can afford to finance a property whose mortgage is between two and two-and-a-half times their annual gross. The longer term will provide a more affordable monthly. Bankrates 401k calculator can help you estimate your retirement earnings.

Poverty is the state of having few material possessions or little incomePoverty can have diverse social economic and political causes and effects. The term originates from the Latin inflare to blow up or inflate and was initially used in 1838 in the regard of an inflation of the currency per the Oxford English Dictionary 1989. The less you borrow.

This estimate will give you a brief overview of what you can afford when considering buying a house. That can greatly impact your decision on whether to choose a 30-year fixed rate loan or a shorter term. Dollar American dollar or colloquially buck is the official currency of the United States and several other countriesThe Coinage Act of 1792 introduced the US.

If you have no deposit and need to borrow the full amount otherwise known as needing a 100 LTV - mortgage you can still get a loan but your options will be much more limited than if you had a. Borrowers within this limit typically receive more favourable mortgage rates. Dollar to distinguish it from other dollar-denominated currencies.

Most UK lenders consider 20 to 30 a low-risk range. Find out how much house you can afford with our home affordability calculator. In economics a recession is a business cycle contraction when there is a general decline in economic activity.

You can also input your spouses income if you intend to obtain a joint application for the mortgage. I can show the derivation of this formula if anyone is interested. Since our founding in 1935 Morgan Stanley has consistently delivered first-class business in a first-class way.

If you make 70K a year you can likely afford a house payment between 1500 and 2000 a month depending on your personal finances. Get an estimate on stamp duty LMI and other non-standard home buying fees that come with purchasing a property. Most lenders ideally like to see a down payment of around 20 of the price of the homePutting 20 down on your home eliminates the need for private mortgage insurance PMI requirements though may lenders allow buyers to purchase their home with smaller down payments.

How Much of a Mortgage Can I Afford. How much can I borrow calculator. The average homeowner puts about 10 down when they buy.

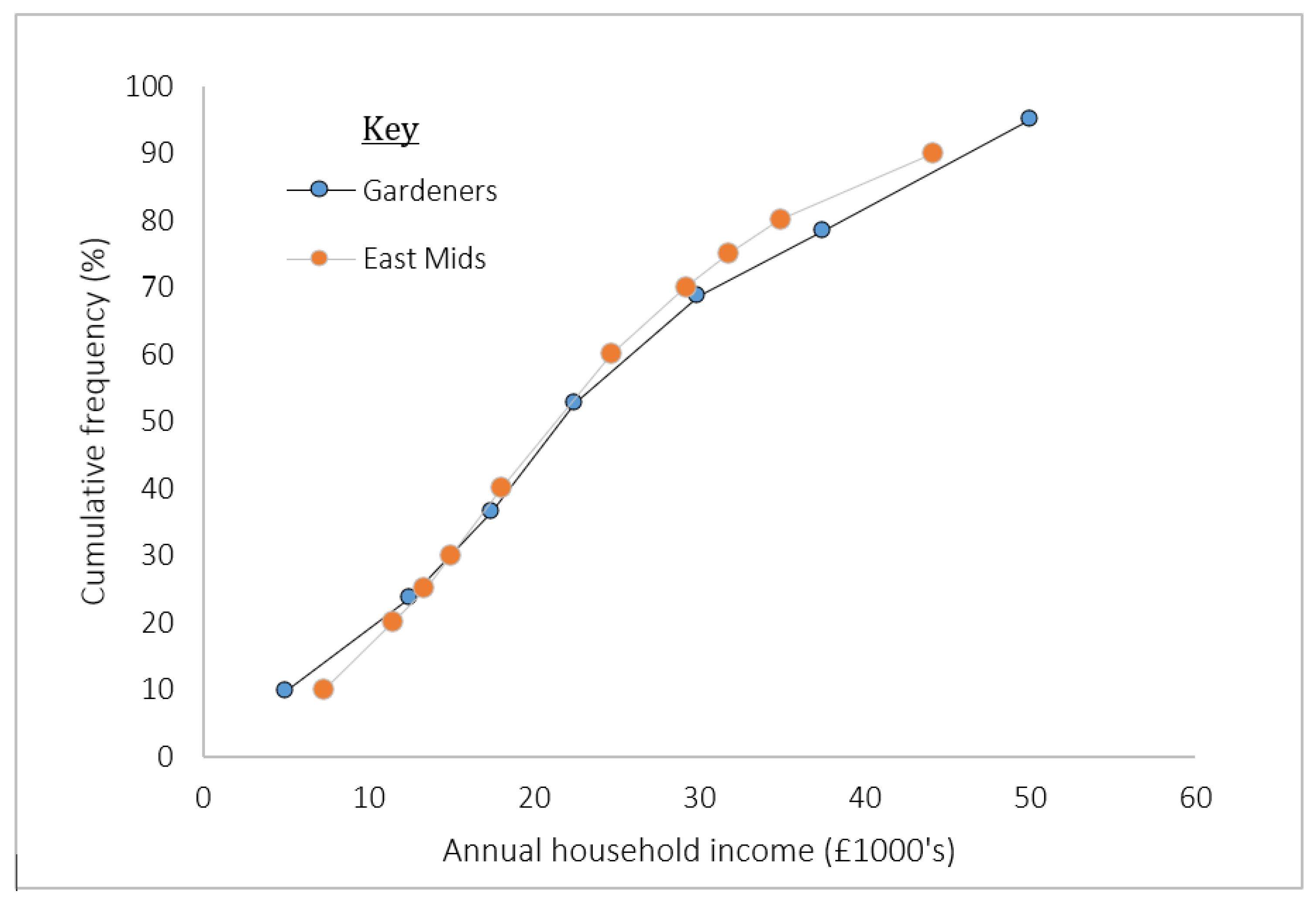

Himax Fairly Priced Based On Normalized Gross Margin Nasdaq Himx Seeking Alpha

Homewise Review Loans Canada

What Is The Income Required To Buy An 800k House Quora

Is It Possible To Get A Loan For A House Or An Apartment And Then Rent It Out Until It Pays For Itself Even If It Takes Like 20 Years Quora

Why Oil Majors 7 11 Dividend Yields Could Be In Danger Seeking Alpha

30 Heart Touching Short Love Quotes For Him Sweet Love Quotes Short Love Quotes For Him I Love You Quotes

Nba Hypothetical The Four Point Line Northwestern Sports Analytics Group

Loaddocument Php Fn Exhibitb2022globalequityoutlook Png Dt Fundpdfs

Ipmt Function In Excel Calculate Interest Payment On A Loan

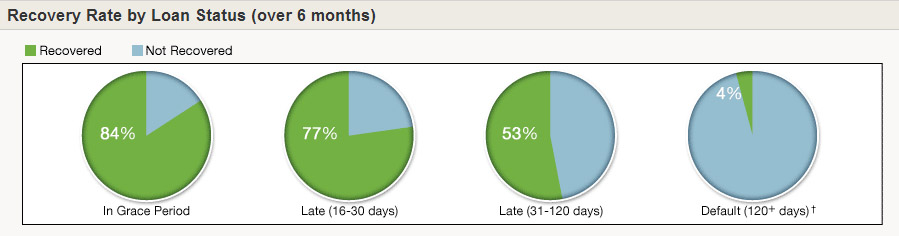

What If Borrowers Stop Paying Their Loans Investors Rates Of Return On A Peer To Peer Lending Platform Sciencedirect

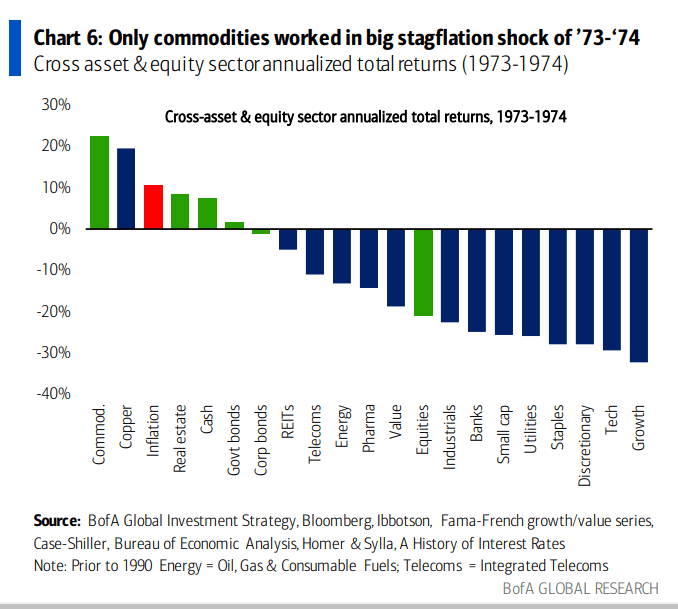

Bear Era Begins With Real Rates At Crashes Panics And Wars Levels Seeking Alpha

![]()

Homewise Review Loans Canada

Moneylion Inc 2021 Annual Report 10 K

The Lending Club Experiment Four Months Later Mr Money Mustache

30 Free Task And Checklist Templates Smartsheet Pertaining To Daily Task List Templ Weekly Planner Template Free Printable Weekly Planner Template Task List

Why Are Interest Rates So Low

Mortgage Lender Woes Wolf Street